HIGH IMPACT COUNSEL

Assess Strategic Alternatives

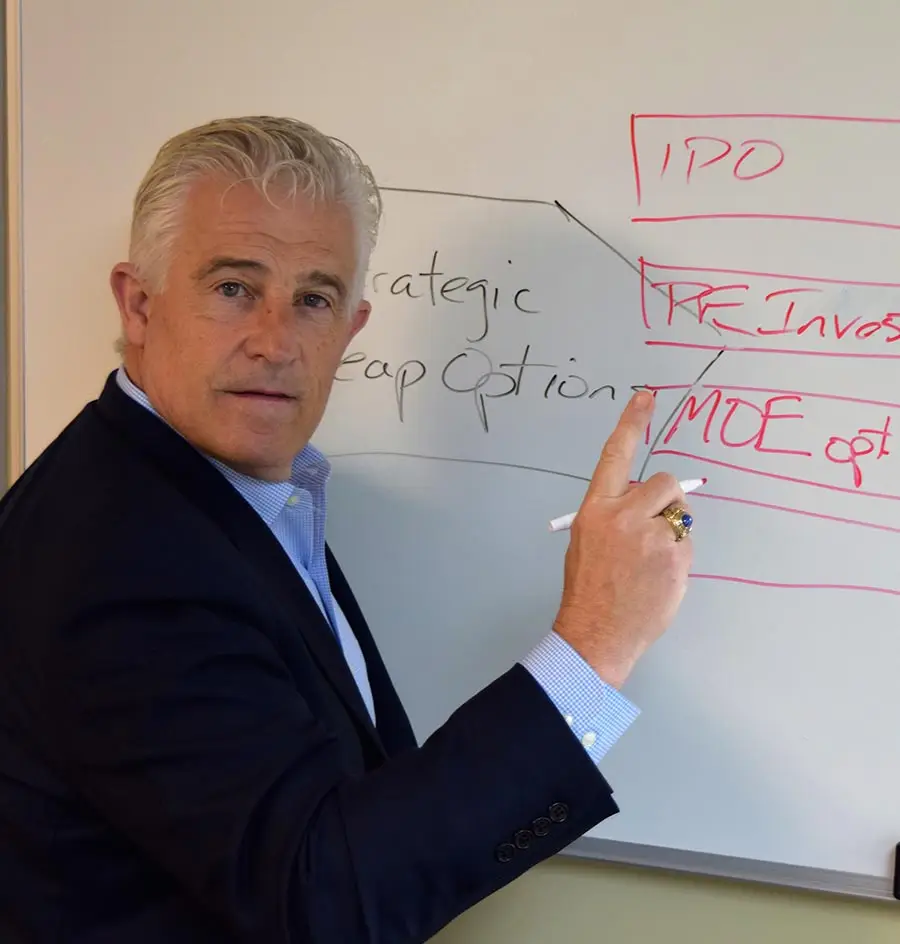

Each company is facing unique strategic alternatives. Most who are experienced and insightful in this arena are in the Investment Banking community. Parker brings a breadth of experience and insights from the perspective of ownership on this topic. Detailed experience in operations, business development, and finance enables Parker to engage deeply and knowledgeably without any motivation other than supporting the best value opportunity for ownership.

Because each company is unique and the market is constantly changing, there are no set answers or approaches for best strategic value.

Strategic alternatives must be addressed in the context of the company and the market and not just one or the other. In assessing strategic alternatives, Parker Strategic first engages with ownership to determine the desires, motivations and capability of ownership and top management. Then, the senior tier of management can be engaged interactively, at a substantial level, to fully understand the business’s market position.

Often ownership is somewhat isolated when assessing strategic alternatives, not having experience with logical potential opportunities. Parker provides a “partner” with experience in both assessing and executing strategic alternatives.

Parker’s support to ownership in this area is only toward enhancing corporate value while most advisors with substantial experience in this area are highly incentivized to get a transaction done. This means that alternatives are objectively analyzed with ownership, considering the overall position of the company and the market opportunity. Strategic actions which can substantially impact value must be identified and approaches for their implementation defined, so that the company can proactively position for best value rather than taking whatever value is assigned for a snapshot in time of operational execution which has not been optimized for a potential sale. In optimizing a company’s position for a potential sale, a myriad of issues should be addressed, including:

- Improvements in financial performance from the perspective of a potential buyer. Parker can guide ownership to make the “adjustments” and demonstrate performance which cannot be discounted by prospective buyers.

- Improvements in business development performance. Addressing such issues as stability and/or independence, continuing effective incentives, and proven business development processes which are not dependent on an individual.

- Infrastructure and organization which can be efficiently integrated into an acquiring entity. Issues such as financial systems and employee benefits to mitigate buyer risk.

- Transition of 8a or restricted business. Parker has engaged successfully with clients with 8a revenues to develop a tight program for 8a transition.

How We can Help

What We Offer

Assess Strategic Alternatives

Each company is facing unique strategic alternatives. Most who are experienced are in the Investment Banking community

Develop Corporate Growth Strategies

Integrating acquired growth, Parker develops strategies that create and build upon real market distinctions,

Transformative Opportunities

Parker Strategic can be engaged to define the actions that must be taken to position the company to win.

Corporate Repositioning

Parker has been successful in repositioning corporations in the marketplace for significantly enhanced value to ownership.